Value Added Tax (VAT)

Value Added Tax are applicable for entrepreneurs who are registered for Value Added Tax (Vat), that’s it. If they haven’t registered (Vat) and then issue a tax invoice, they will be considered a legal offense.

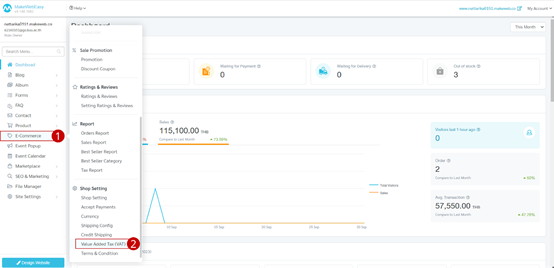

1. Go to menu “E-Commerce”

2. Go to “Value Added Tax (VAT)“

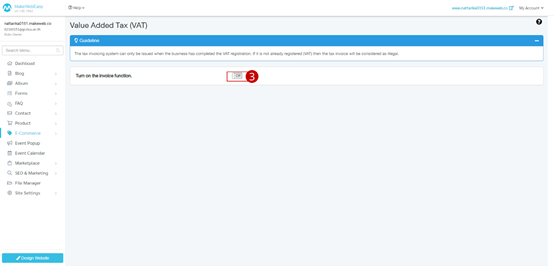

3. Click to enable the VAT system.

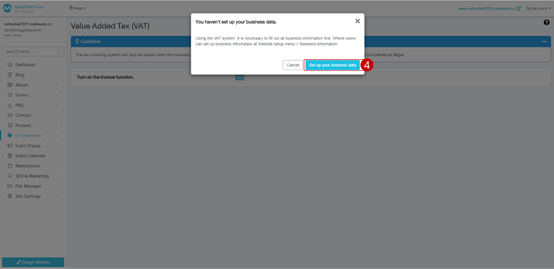

4. The system will display a notification screen for the store owner to set up business information. Click the Set up business information button.

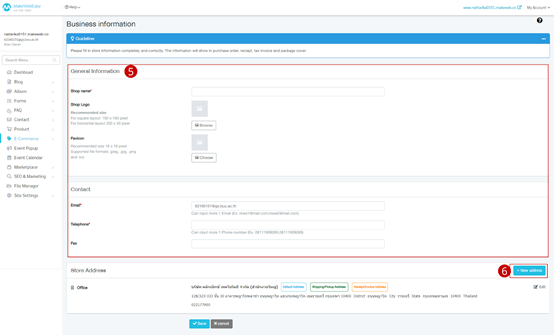

5. Add complete business information, general information, logo and favicon, and contact information.

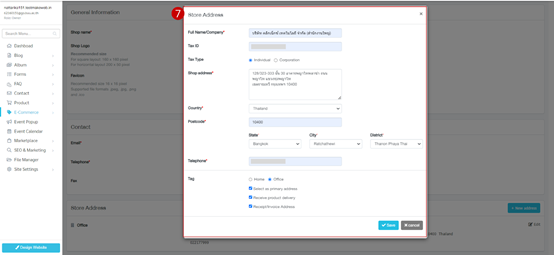

6. Click on “New address” to fill in the store address information and taxpayer number.

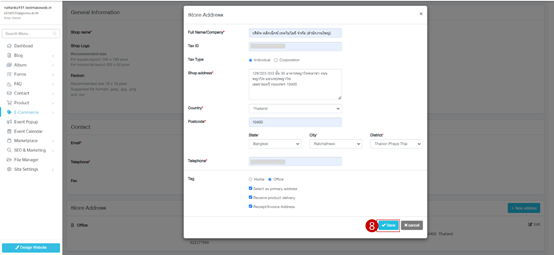

7. The system displays a Modal to enter the store address. It consists of first and last name, taxpayer number, taxpayer type, address, country, zip code and telephone number

8. Click on the button “Save”

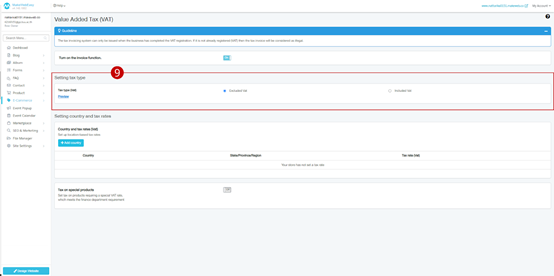

9. The system returns to the e-commerce menu > Value added tax system by setting up tax calculation formats. there are 2 formats to choose from:

- Product price does not include tax (Excluded Vat) = Product 100 baht + Vat 7% = 107 baht

- Product price includes tax (Included Vat) = Product without including Vat 93.46 including Vat 7% = 100 baht

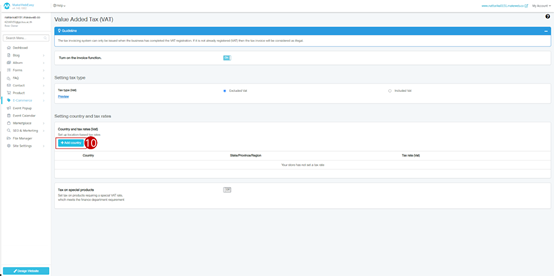

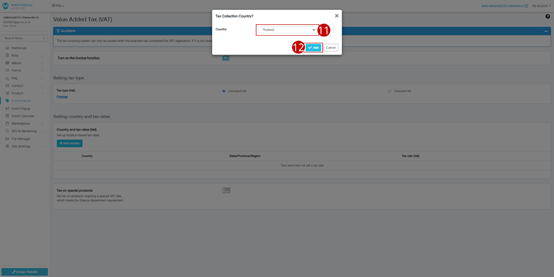

10. Set country and tax rate click the button “Add country”.

11. Select the country you want to collect taxes from, as an example, choose Thailand.

12. Click on the button “Save”

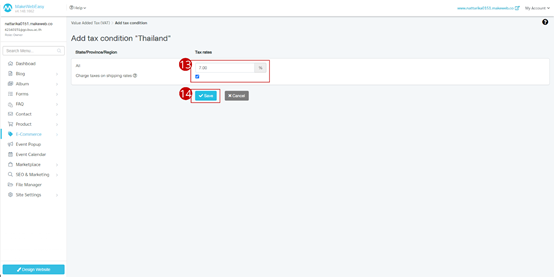

13. Set the tax rate for the selected country. From the example, it will be set to 7%.

14. Click on the button “Save”

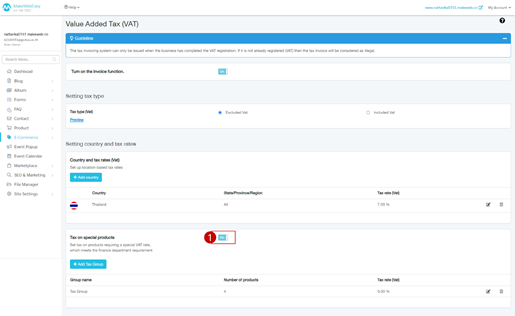

15. The system displays a screen for completing tax settings: country, state/province/region, tax rate.

From steps 1-15, it is a VAT setting for online stores that sell general products. without special group products

Additional advice

For Thailand, there will be a single tax rate of 7%, and for other countries where taxes are collected differently in each state, such as the United States, the MakeWebEasy system supports this setting.

For product groups that are exempt from VAT

For online stores that sell general products. along with selling tax-exempt products on the same website, such as a website that sells agricultural products by selling lawn mowers and chemical fertilizers, the function “Tax for special product groups” can be used. There are steps on how to exempt VAT:

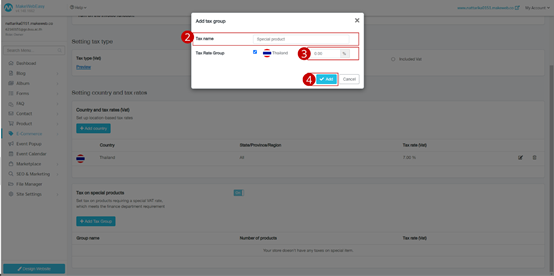

1. To enable tax for special product groups, turn on toggle

2. Name the tax group.

3. Set tax rates for special product groups.

4. Click on the button “Add”

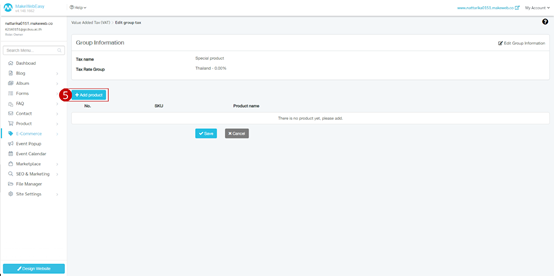

5. The system displays a screen for adding products to tax groups. Click on the button “Add product”

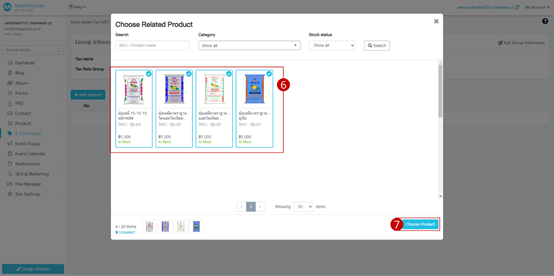

6. The system displays a screen for selecting products. Users can choose products according to their needs.

7. Click on the button “Choose Product”

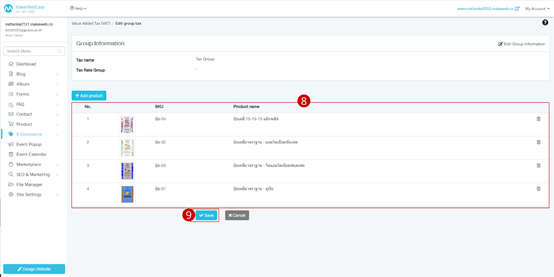

8. The system displays a list of products selected for special tax groups.

9. Click on the button “Save”

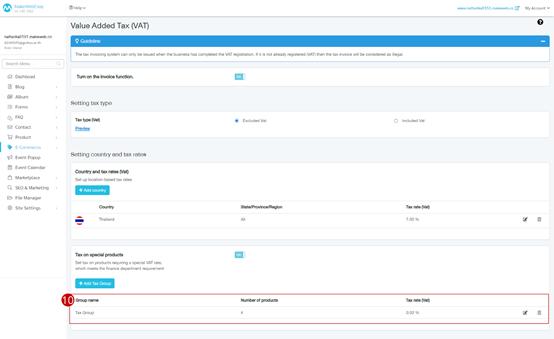

10. The system displays a screen for setting up special group taxes. It will display information tax group name, product quantity, and tax rate.

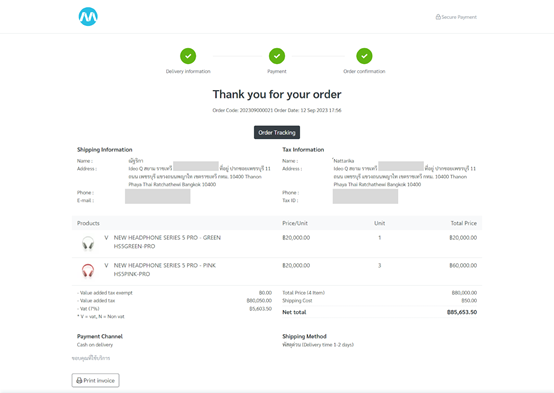

Example in the case where a store opens the VAT system

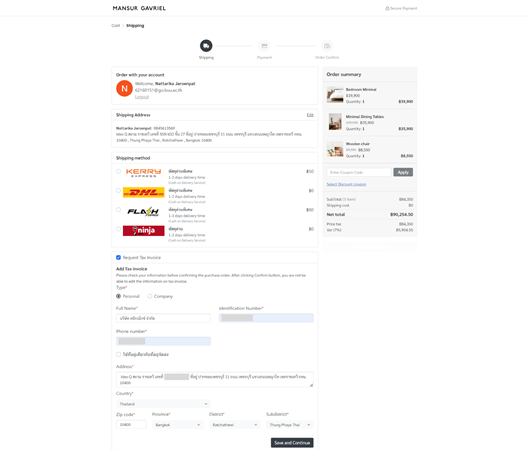

Example case of requesting a tax invoice